DT Business Observer has conducted a survey on collaborations, in particular from tea and coffee chains. Among the 1023 respondents, 85% were people born in the 1990s and 2000s. 75% of the respondents were women and over half were from tier-1 cities. DT argues that this is the primary profile of consumers interested in collaborative items.

DT has observed that over half of the people feel indifferent about crossovers and do not feel compelled to get them but will buy them if they have the chance to. About a third of participants have a stronger interest towards these collaborations compared to last year, while 44% say their interest remains about the same.

Over 80% of the respondents had purchased co-branded coffee or beverages while nearly 70% had bought co-branded food. During a time of a “consumption downgrade”, lighter and cheaper products are preferred, and Luckin Coffee and Hey Tea made the most successful collaborative campaigns in the past year. We are going to look at some of the most memorable campaigns and why they worked (or didn’t work).

Luckin x Maotai

The most impressive collaboration of the year was the Luckin Coffee x Kweichow Moutai (Maotai) baijiu liquor latte. According to DT’s survey, it is the most memorable collaboration of 2023.

The DT survey indicates co-branding campaigns are noteworthy for several reasons. Nearly 60% of the respondents feel that creative products will leave an impression, and over 40% think the contrast between partners is what makes a collab stick. The team-up between a coffee chain and a time-honoured prestigious baijiu label with the result being a liquor latte is a combination of both. Nearly 40% believe that being memorable is important. Indeed, many memes and jokes have spawned out of the collaboration. Also, over a fifth of the participants think that partnerships with old Chinese brands are also significant.

Maotai x Dove

Following its success with Luckin coffee, Maotai collaborated with Dove the chocolate brand. However, the launch was too close to that of the liquor latte campaign, therefore the co-branding was understandably not nearly as well-received. However, it did make it to number 10 on the list of memorable campaigns from DT’s survey. Regardless, lacklustre sales of the chocolate may have been the reason Maotai then paused all collaborations soon after its launch.

Indeed, according to DT’s survey, the reasons people purchase certain co-branded items are rather different to just leaving an impression. Over 70% of participants made a purchase because of the IP that was involved in the collabs. 60% voted for delicious/fun/useful products while a little over half would buy because of the merch and gifts. Almost the same number of respondents think liking the brands is a reason for purchase. The Maotai x Dove might have lost a little of the element of surprise in comparison to the Luckin collab, and equally Dove, or chocolate does not command the same popularity as Luckin or coffee in general.

Luckin x Tom & Jerry

The cheesy mascarpone latte from Luckin, did not break the internet like the Maotai latte preceding it, but it did leave a lasting impression on its consumers. It was voted the second most memorable co-branding campaign of the year by the DT survey. Interestingly, Luckin brought the cat and mouse duo back for Christmas with a new strawberry liqueur-flavoured latte. Different from last time, the new drink comes with more than just cups, sleeves, paper bags and stickers. In the spirit of Christmas, free wallpapers for smartphones and computers were shared on Weibo, China’s Twitter-like platform. The topic “Luckin Tom & Jerry Christmas” (#瑞幸猫和老鼠圣诞#) earned 3.67 million views on Weibo.

Hey Tea x Fendi

Luxury crossover ranks number 4 of the top reasons for a memorable campaign, according to DT’s survey, with nearly 30% of people voting for it. This was proven as Fendi’s collaboration with Hey Tea ranked number 3 in the top 10 memorable campaigns in the same study. However, the campaign was not without fault. Although the tea sold out almost instantly at offline locations in tier-1 cities, Fendi hardly promoted the crossover on social media, apart from introducing the co-branded tea as a beverage partnership at its Beijing exhibition.

Some speculate that it is because Fendi did not want to invest too heavily in marketing, as Hey Tea is a mass-market brand and the co-branded tea sold for 19 RMB (2.66 USD). With an order of two teas, the customer can choose from a free coaster or badge. While it indeed incorporates the contrast factor that commands the attention of consumers, many felt that it was a great win for Hey Tea but not necessarily for Fendi. The luxury status prevented Fendi from committing to the marketing of the co-branding, making it hard for them to get the desired effect of promoting the brand and harnessing Hey Tea’s fan base. But the campaign did elevate Hey Tea to a more premium and “cool” status.

Nayuki x MINTS/Fantasy

Ranked number 5 on the list, this collaboration was memorable, but not necessarily in a good way. It was controversial from the start because of its convoluted rights issue. In September 2023, Nayuki advertised that it would co-brand with Jay Chou’s 2001 album Fantasy. However, consumers soon found out that Jay Chou was not involved in the co-branding and would not profit from it. Nayuki had actually partnered with MINTS, a tech company focusing on NFTs and other web3 content.

Chou was in fact in partnership with MINTS and they had received the rights to Fantasy as part of its deal with Chou’s JVR label to create a metaverse-like virtual space for the album. The Nayuki collaboration was using MINTS’ rights to the Fantasy album, therefore JVR and Chou were not involved and Nayuki could not use the name of the artist in any of its promotional material. Consumers buying the tea received access to the Fantasy virtual universe, which included 5 demo tracks from the album.

With fans only interested in the demo track, the virtual space remained mostly empty after launch

Another controversy was the high price of 39.99 RMB (5.60 USD). The milk tea normally cost 18 RMB (2.52 USD), which means the supposedly “free” access to the Fantasy land was actually sold to fans for 21.9 RMB (3.07 USD), more than the tea. With fans only interested in the demo track, the virtual space remained mostly empty after launch. The value of the tea was therefore questioned. In fact, according to Meituan’s data, customers have shown a higher preference for beverages than food recently. Brands with lower average prices (less than 15 RMB/2.10 USD) continue to see a consistent increase in popularity, whilst the growth of higher-end brands has slowed down.

Hey Tea x “Speechless Buddha”

The DT survey acknowledged that this partnership was released after its survey, so it was not included. Having topped the Hot Search list on Weibo for both the release and its withdrawal, this campaign is certainly worth mentioning.

Hey Tea launched this collaboration with Jingdezhen China Ceramics Museum. The partnership capitalised on the “Speechless Buddha” memes based on ceramic sculptures from the museum. The statues depict the 18 Arhats or Luohans in Chinese, mostly disciples of Buddha, from Buddhism. However, the Shenzhen Municipal Bureau of Ethnic and Religious Affairs held a “regulatory talk” with Hey Tea after suspecting the depiction of religious figures might violate the Religious Affairs Regulations. Although it is contested whether Hey Tea and the museum were governed by the regulation, Hey Tea cooperated and pulled the products.

Certainly, it is hard to foresee this kind of trouble before releasing a co-branded item. However, Hey Tea’s misfortune has provided others with a valuable lesson, especially in their cooperative way of dealing with the controversy.

Hey Tea’s misfortune has provided others with a valuable lesson, especially in their cooperative way of dealing with the controversy

Picking up from the point about merch and gifts, it is indeed where a lot of both creativity and being fun/useful comes from. Given that most memorable and bought collaborations are from tea and coffee brands, innovating on the taste has its limitations and unconventional tastes are not always welcome (the strawberry liqueur latte from Luckin seems to have run into that problem).

The design of merchandise and complementary gifts is where most collaborations can differentiate themselves. Cups, sleeves, paper bags, magnets and stickers have become collectables and unused items are sold online, sometimes at very high prices. Consumers also form group chats to exchange information on collaboration bags and merch, with some even using them as materials for DIY projects.

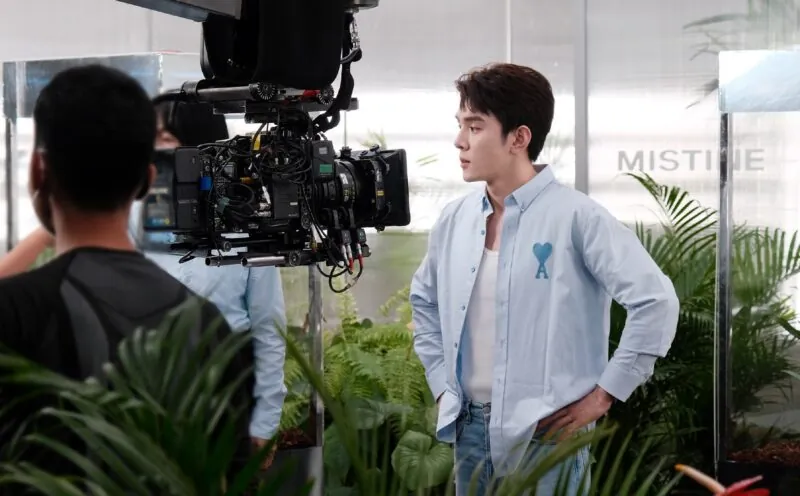

Another point worth mentioning is that the Nayuki x Fantasy co-branding actually builds on two collaboration trends of 2023; one being nostalgia, as exemplified by the success of the Tom & Jerry collabs and the other being musical artist collaborations, which the Nayuki one technically is not. Examples include singer Jackson Wang’s partnership with tea brand Chagee, folk rock band Wutiaoren with More Yogurt and pop star Roy Wang with Mixue Bingcheng.

Collaborating with tea or coffee chains can help brands tap into the young, urban, professional and predominately female audience

Consumer enthusiasm remains largely unchanged according to the survey, even with this many collaborations in 2023. However, these campaigns remain an important marketing technique. The key to successful co-branding campaigns lies in memorability and sales, which the research shows are two different things. Partner selection and the products, including merch and gifts are the two most important things for brands to consider when looking into collaborations. Also, partnering with tea and coffee brands seems to be a winning formula for IPs and brands. Collaborating with tea or coffee chains can help brands tap into the young, urban, professional and predominately female audience that responded to the DT survey. While tea and coffee brands can benefit from luxury, designer or artist co-brandings to elevate the brand status and narrative.