Since last year, the term “white label” has dominated retail and e-commerce in China. From fashion and FMCG to appliances, it seems all brands are facing the threat of white-label goods. But no other category faced such a close-quarter battle against white-label equivalents than beauty, specifically C-beauty.

No other category faced such a close-quarter battle against white-label equivalents than beauty

White label originally meant retailer-owned private labels, such as ASDA’s George or Costco’s Kirkland. But it has soon come to mean the manufacturer’s own brands, as well as the e-tailer’s own brands. Today, the term white label can mean any smaller non-name-brands that are picking up traffic, especially on e-commerce and social commerce platforms such as Douyin, TikTok’s Chinese sister app.

The rise

In April 2024, the media began picking up on the sudden rise of “white label” products that were entering the fray of the e-commerce and retail landscape. The white labels usually boast as being part of the supply chain to name brands and assure consumers of their quality this way. Meanwhile, with “affordable substitute” (平替) and “rational consumption” being the prevalent consumer sentiments, these OEM-turned-labels quickly found an audience.

By June, e-commerce platforms were focusing on providing absolute low prices and competing to be the lowest on the web for the 618 sales festival. That was when white labels flourished. From sales livestream channels to platforms such as Alibaba’s enabling ordering from 1688 merchants (usually manufacturers) directly from Taobao, it was easier than ever to buy white-label goods. White-label brands such as Dr Wen, VC and Creator made it to Douyin’s list of fastest-growing brands. Dr Wen topped the list with 13,388.67% growth. However, sales fell significantly after losing the huge exposure it had in the first half of 2024.

For this reason, analyses usually pointed to the huge exposure and traffic driven by the platform, which made it so popular. Many also feel it was a transfer of trust from brands to channels – either the streamer or the e-commerce platforms selling these goods.

The fall

After 618, e-commerce platforms began to move away from absolute low prices to focus on gross merchandise volume (GMV). It was also reported that white-label brands began to reshuffle among themselves. Some white-label brands faded into unsustainable price wars while others tried to turn themselves into brands. The result of this has been that established C-beauty brands such as KANS and Proya remain at the top of sales rankings. While white-label competitors have also made it to the list, there has been a significant reshuffling among these brands.

There has been a significant reshuffling among top white label brands

In December, it was reported that Douyin, one of the key platforms for white labels, confirmed it would manage brands and white labels under one umbrella, albeit as two distinct groups. For brands, the key performance indicator would be GMV, while for white label goods, it would be the number of orders. The reason it gave was that over the past 2 years, many of the white labels had grown to become brands, so having a centralised management would help with the dynamism between the two.

And rise again

In January 2025, it would seem that white-label beauty has made a return. The latest ranking of the top 20 skincare brands on Douyin shows that C-beauty brand KANS made it to the top and Proya in second place. Meanwhile, Chinese brand Guyu also overtook L’Oréal to be number 3. 13 brands on the top 20 list are Chinese.

7 of the 13 Chinese brands are considered white labels, from DCEXPORT, Lefilleo to HEXKIN, compared to only 3 in January 2024. 7 white labels including 3ZT (三资堂), Xiaoshumei and ELL made it to the top 20 cosmetics/fragrance/beauty tool ranking. 3ZT grew significantly since entering the beauty ranking in December 2023 and topped the Douyin list in both December 2024 and January 2025.

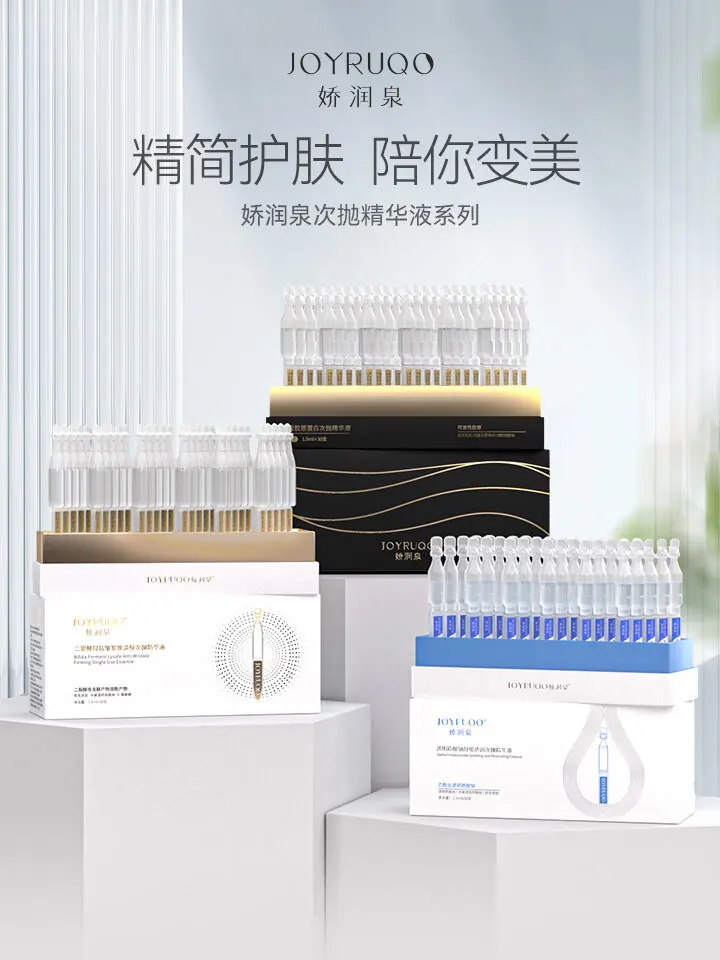

However, if compared with 2024 lists, the white label names have changed significantly with familiar names such as Joyruqo and Dr Wen dropping out of the top 20, in contrast to when Joyruqo ranked number 2 after KANS in January 2024.

As white-label brands are exempt from the effort of maintaining a brand, they are also limited to a short-term approach, in beauty or other sectors. Most of their sales come from powerful ads and large-scale exposure from platforms, usually for certain hero products or particular livestreamers and influencers. However, as they all focus on the top trending categories of items, it becomes hard for them to differentiate between each other. When asked about whether it is likely for white labels to turn into brands and become sustainable, pundits express their concerns mostly around how deeply interconnected these labels are with their channels and platforms and the short-term mindset they run on.