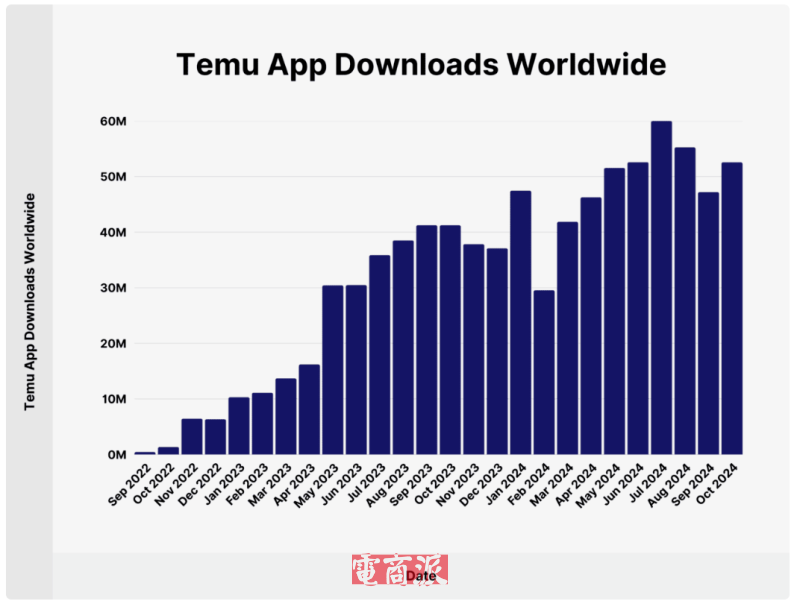

Temu has quickly become a standout in cross-border e-commerce. As of Q2 2025, its global monthly active users (MAU) hit 416.5 million—a 68% year-over-year increase. That’s roughly one in every 18 people worldwide using the platform.

Growth varies by region, but overall momentum remains strong. In the EU, MAU jumped 74% year-over-year, now accounting for 34% of Temu’s global user base. Sensor Tower data shows user growth this June reached 76% in France, 71% in Spain, and 64% in Germany. Only the U.S. tells a different story. Temu’s user base there shrank 28% year-over-year, largely due to rising trade tensions. In response, the company is shifting its focus to less volatile markets in search of new growth and lower risk.

Latin America is the brightest spot. According to Payments and Commerce Market Intelligence, Latin America’s e-commerce market is expected to top $1 trillion by 2027. In Brazil, Temu entered the market last year with its signature low-price, high-subsidy strategy. Perks like free shipping, first-time discounts, and flash coupons helped it pull in 56 million clicks in April alone—pushing it past Shopee to become the second-largest e-commerce platform in the country by traffic.

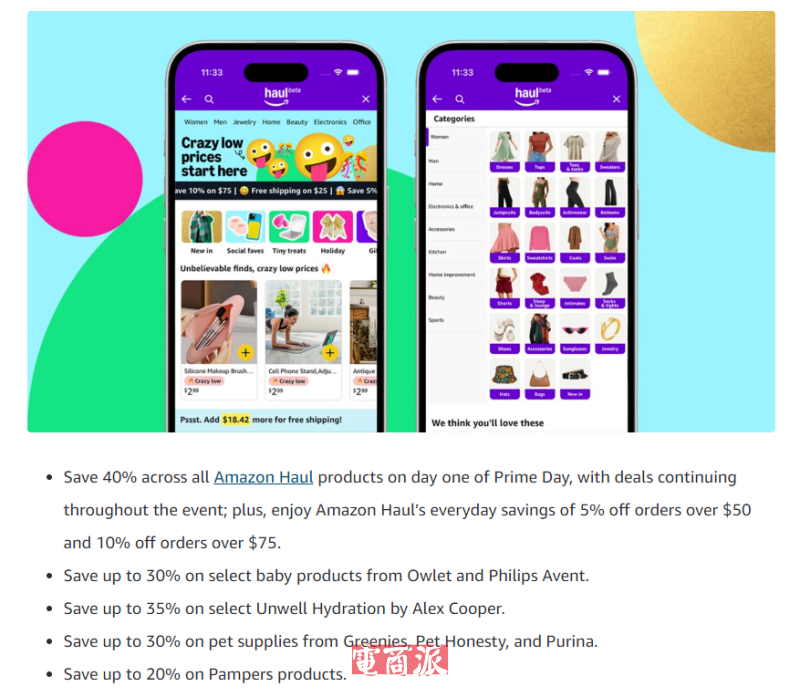

Still, Temu’s rise isn’t without obstacle: competitors are stepping up. Amazon recently launched its budget-friendly platform, AmazonHaul, in a direct challenge to Temu’s model. In an increasingly crowded and unpredictable landscape, staying competitive will require e-commerce players to stay agile, rethink strategy, and keep expanding into untapped markets.