On May 6, Aesop announced it will shut down its Dongping Road store in Shanghai—its first location in mainland China—after May 10. The store opened in November 2022, making its closure come just two and a half years later. Aesop told Beijing Business Today the decision was due to the lease expiring.

This marks the brand’s first store closure in China. Even before being acquired by L’Oréal in 2023, Aesop saw strong growth in Asia, with the region accounting for half of its global sales. China, in particular, was its fastest-growing market. Since the acquisition, Aesop has ramped up expansion, opening roughly one store per month. It now runs 21 stores across China (including airport locations), with the highest number in Shanghai.

The shutdown has sparked debate within the industry. Some insiders say Aesop’s push into the luxury space is most visible in its pricing strategy. For instance, Tacit Eau de Parfum (50ml) rose from 850 RMB (117 USD) to 1250 RMB (173 USD), while Marrakech Intense Eau de Parfum (50ml) jumped from 545 RMB (75 USD) in 2020 to the same 1250 RMB—an increase of 129% over five years. More recently, Aesop raised the price of its 75ml hand cream by 10%. While its product line is broad and its store design reinforces a premium image, Aesop still offers relatively few high-end products. Therefore its price hikes have raised some eyebrows—especially as luxury spending shows signs of slowing.

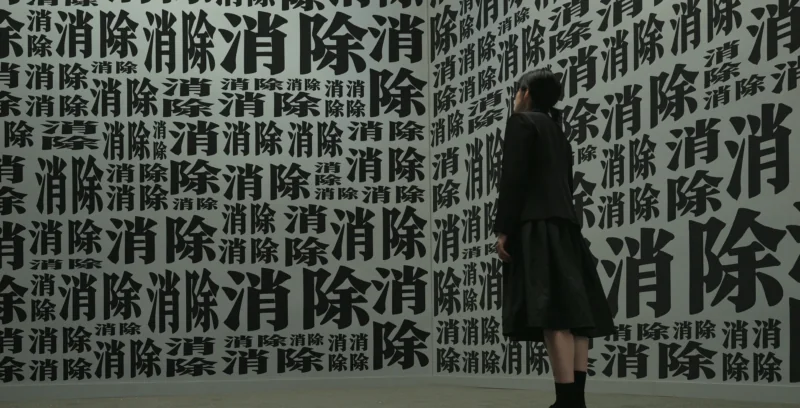

Brand strategist Zhan Junhao notes that China’s high-end beauty market has become intensely competitive, giving consumers more options than ever. Kering has announced its entry into the market via its fragrance line: In 2024, L’Oréal started developing and selling fragrance and beauty products for Miu Miu. Estée Lauder brought Le Labo to China in 2023 and opened its first store. Meanwhile, local niche fragrance brands such as DOCUMENTS, To Summer, and Melt Season are gaining traction and have already attracted investments from L’Oréal and Estée Lauder.

The Dongping Road closure reflects the broader challenges Aesop faces as it grows in China. With fast-expanding retail networks and mounting competition, its street-front stores are feeling the strain of inconsistent foot traffic and high operating costs. Malls and airports, offering steadier crowds and greater efficiency, may now present a more viable strategy. Aesop’s future in China will likely hinge on how well it balances brand identity with the market’s rapid pace.

Need to boost your China strategy? Dao Pro delivers bespoke insights on marketing, innovation, and digital trends, direct from Chinese sources. Find out more from our Dao Strategy Team here.