With the success of Mixue’s Hong Kong IPO and the progress in “going overseas” (出海) of CHAGEE, it is no surprise that the brand aiming to surpass Starbucks is planning a public listing. On 6 March, the news came that the China Securities Regulatory Commission (CSRC) had released a notice on the overseas offering and listing of Chagee Holdings Limited. This is generally considered good timing as it was 3 days after Mixue broke the “below issue price curse” experienced by the first 3 “New Style” bubble tea makers who went public.

The notice details Chagee Holdings’ plan to release no more than 64,731,929 common stock shares and be listed on the Nasdaq or New York Stock Exchange (NYSE). The CHAGEE brand owner, however, only responded with a simple “all is subject to the CSRC disclosure”.

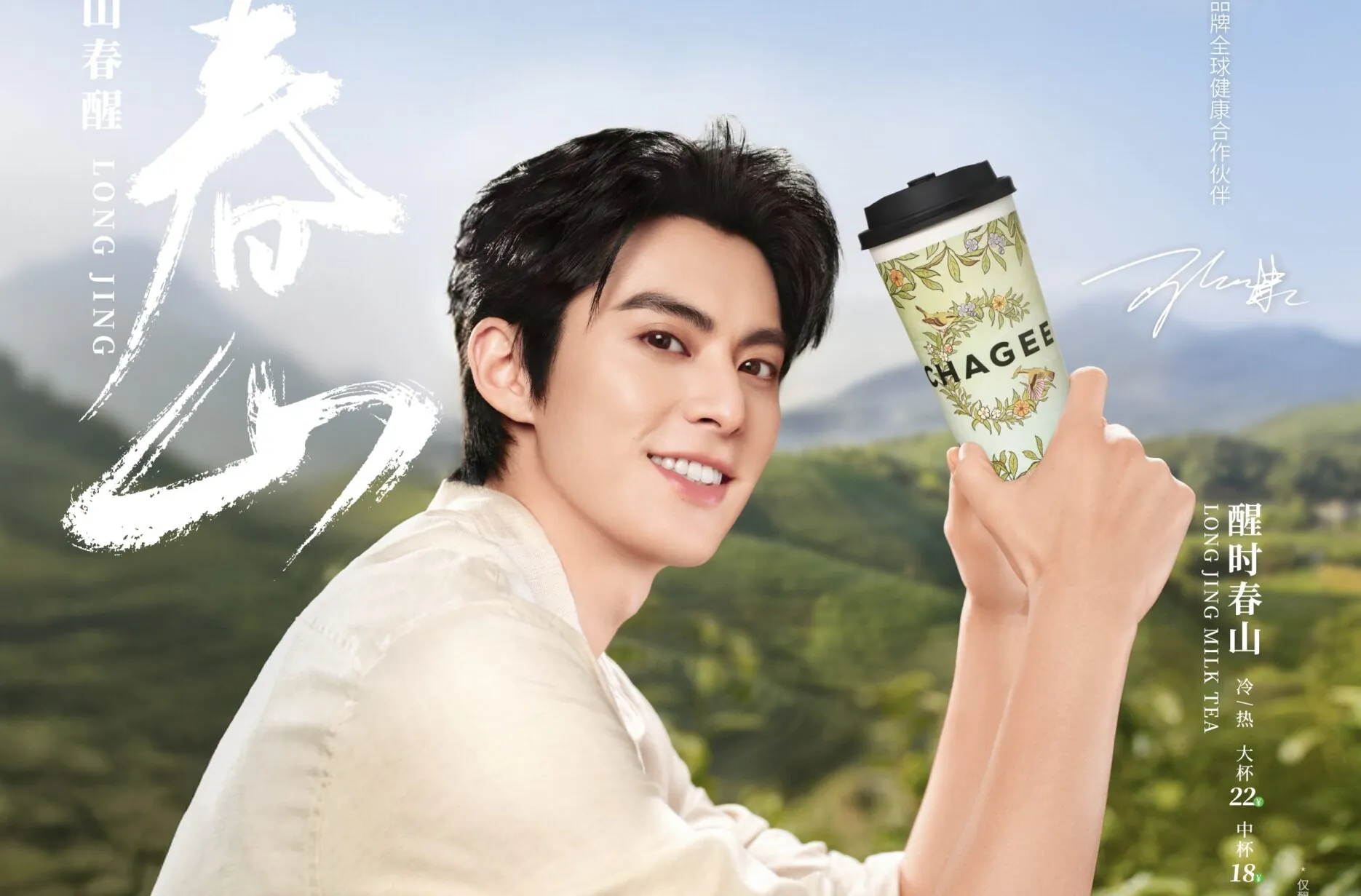

CHAGEE, founded in 2017, is known for its real-leaf tea and dairy milk tea, as well as fruit tea drinks. It currently has 6,200 locations across the globe, with over 6,000 in China. With only 1,000 branches in January 2023, the chain opened over 5,000 stores in just 2 years. In 2024, CHAGEE announced that its target is to surpass Starbucks in China in terms of sales revenue.

The “new style Chinese tea” market is saturating in China, with local brands expanding into national chains while over 150,000 branches closed their doors in 2024. The recent wave of going public in Hong Kong and CHAGEE in New York are interpreted as steps to quicken international expansion. However, with difficulties in supply chains and costs, it might take time and, of course, investment to see how they fare abroad.

Need to boost your China strategy? Dao Pro delivers bespoke insights on marketing, innovation, and digital trends, direct from Chinese sources. Find out more from our Dao Strategy Team here.