Marriage and birth rates are two of the most watched indicators in China’s society. Not only has the population in China been decreasing for 3 years in a row, but the marriage rate has suffered as well. In 2024, the marriage rate in China dropped again, this time by 20%. This was due to a combination of factors, including the end of the 2023 post-pandemic marriage boost, the “cooling-off” period that was introduced to discourage divorce, the Year of the Dragon was a “widow year” because of the lack of Lichun (立春) solar term, or the start of spring. Young Chinese people, single, dating or married, are also looking for alternatives to children, from pets to plushies, all the way to AI.

Young people in China, single, dating or married, are also looking for alternatives to children

Reigning cats and dogs

The pet economy has been one of the hottest topics in the consumer market. In 2024, it was reported that China had more pets than toddlers and babies below the age of 4 for the first time. By 2030, pets will be twice the number of small children. Families with pets are now over 100 million.

In what’s called the era of “pet-keeping 3.0”, pets are becoming “family”, taking on the role of children. For reference, the 1.0 era was of the functional guard dogs or mouser cats, while 2.0 saw better nutrition, health, and quality of life for pets. We have been hearing about pet-friendly shopping and dining for a few years now, and since the Chinese New Year (CNY), travelling with pets is becoming easier than ever. From having your pet in the cabin with a seat on planes to the high-speed train in China trialling pet transportation, all the way to pet-friendly hotels, travelling with pets is becoming increasingly accessible.

Pets not only provide “emotional value” for their humans, but are equally being provided with “emotional value”. Elderly pet care, pet funeral services and pet “schools” that offer daycare and training are all becoming popular. On top of high-end food, healthcare and apparel for pets, the “childcare-like pet-keeping” (育儿式养宠) has birthed over 4.2 million startups as of this January in the pet economy sector. This is partly because the younger generations are more willing to spend money on their pets than on themselves.

From JellyCat to LABUBU

For those who are still willing to spend money on themselves, there is a term called “self-pleasing” (悦己) or “self-care” (宠己), which became Alipay, Alibaba’s payment platform’s word of the year in 2024. Younger consumer cohorts who shop for themselves are usually single, and they buy for their own pleasure instead of for other people, including family. “Emotional value” is also a key term for them.

For many of the “self-pleasing” crowd, collectible “goods” (谷子, meaning merchandise), especially those from POP MART and Jellycat, are especially popular. POP MART, which recently became the number 1 shopping app on the Apple App Store in the United States, has also been seeing long queues outside its stores stateside as well, despite a price hike for its star product, the LABUBU figurines, after its third-generation update. The LABUBU boom has also reached the UK and Thailand, as well as the second-hand market in China.

Meanwhile, the British plush toymaker Jellycat, also popular, is facing a very different situation in China. Its playful and immersive shopping experience with role-play of CAFÉ in Shanghai has caused many an imitator to arise. From museums to brand campaigns, the term “xxx has its own Jellycat” has become a viral phrase.

And everything in between

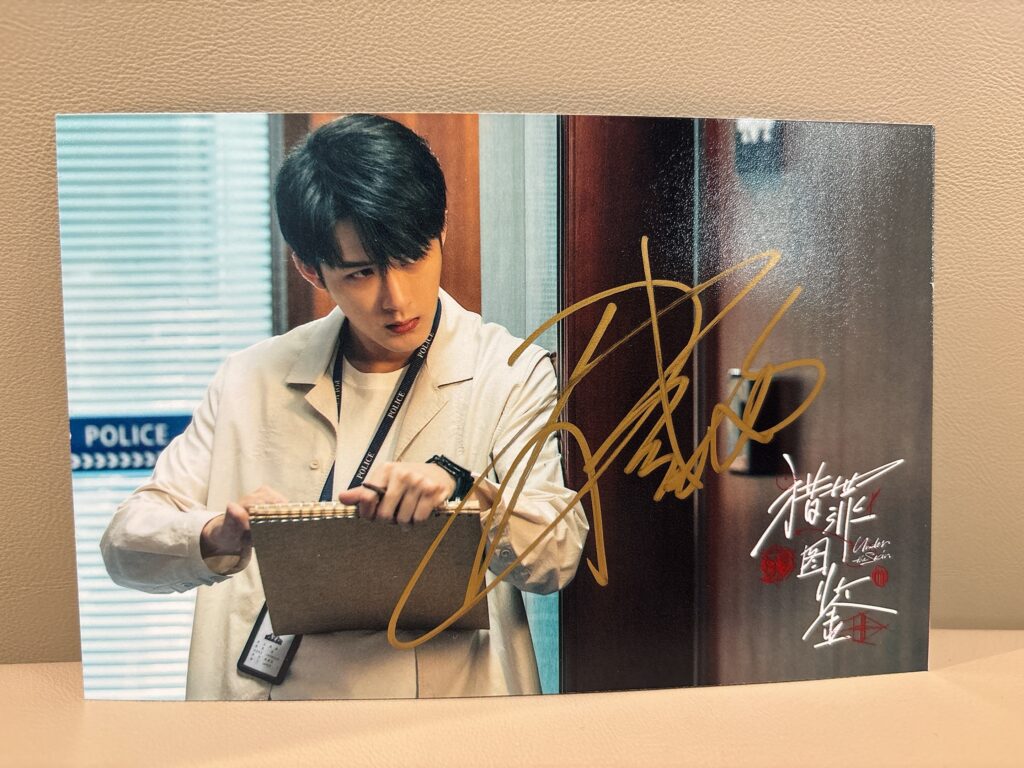

But lately, another class of plushies is taking the place of both pets and the collectible toy for many young Chinese: “cotton dolls” (棉花娃娃). These plushies are usually “chibi” cutesy styled characters from popular ACGN (anime, comics, games or light novels), as well as live-action film, TV and even celebrities. Collectors usually call these dolls/plushies “babies” (娃), themselves “moms” (娃妈) and their collecting activity as “rearing babies” (养娃). This is a great subversion of the popular terms “娃” and “养娃” often used by parents of small children on social media.

Like the general Chinese “goods” market, the “babies” plushies sector is also a mix of official releases from the IP holders and group buys based on fan art. Like pet owners and toy collectors, and real parents for that matter, these “moms” also fill their social media with their “babies” from everyday life to travel photos. For many, the main cost in the process of “rearing” their babies is the outfits for the dolls to appear in on social media, which is where much of the business is.

The childless generations are also creating more markets as they grow

Although it might be a hard time for those working in the children-centric sectors, the childless generations are also creating more markets as they grow. From pet owners to toy collectors and doll-mothers, the “emotional value” is always key. With the advent of AI-enabled robots, toys and plushies, the trend might continue growing stronger among Chinese consumers.

Need to boost your China strategy? Dao Pro delivers bespoke insights on marketing, innovation, and digital trends, direct from Chinese sources. Find out more from our Dao Strategy Team here.