Cotti Coffee recently announced the launch of a marketing campaign starting from 1 June, during which all beverages will be on sale for 9.9 RMB (approx. 1.40 USD) without limit, except for a small number of special shops. Concurrently, Cotti unveiled the COTTI Express, a new convenience type shop featuring a small footprint, minimal investment, and a low break-even point. These shop-in-shop outlets will be widely integrated into various formats and scenarios, such as convenience stores and restaurant chains.

Chief Strategy Officer for Cotti Coffee disclosed on 24 May that the business is ready for a three-year “9.9 RMB campaign”. Third in the Chinese market, Cotti Coffee’s worldwide shop count as of February 2024 was 7,000.

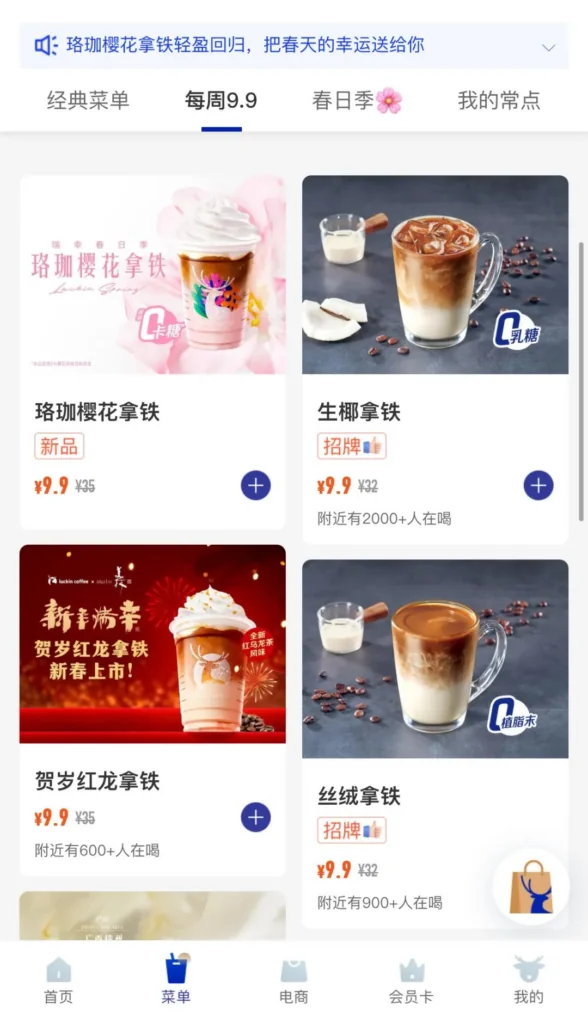

In order to grab market share—especially from rival Luckin Coffee—Cotti Coffee unveiled the “9.9 RMB coffee promotion” in February 2023. The rivalry between Cotti Coffee and Luckin Coffee began when Cotti Coffee’s founder Lu Zhengyao, a former founder of Luckin Coffee, was forced to leave the company in 2020 due to revelations of falsified business data. On 24 May, the Weibo (China’s Twitter equivalent) topic #9.9 Coffee War Drags Down Cotti Coffee And Hurts Luckin Coffee# (9.9咖啡大战拖垮Cotti Coffee熬伤Luckin Coffee) attracted 42.06 million views.

For coffee brands, the 9.9 RMB low price strategy inevitably decreases profits, demands significant scale effects but has supply chain advantages. According to Luckin Coffee’s quarterly report released in early 2024, the first three months of this year saw a transition from profit to a net loss of 71.42 million RMB (approx. 9.86 million USD). Additionally, some Luckin Coffee stores have changed their 9.9 RMB promotional activities since January 2024, which resulted in customers complaining about reduced benefits.

The 9.9 RMB price war has made Cotti Coffee’s franchisees run with lower profit margins, which led to many shop closures. Public information shows Cotti closed 826 stores from November 2023 to February 2024. When searching “transfer Cotti shops” on social media platforms, there would be posts from many areas. On 29 April, Cotti Coffee said that the present shop subsidy policy will last until 31 December 2026. With subsidies dependent on rent and competition, this policy covers both current and future stores; the highest single-cup subsidy has reached 14 RMB (approx. 1.99 USD). For franchisees, this action has somewhat reassured them.

Cotti and Luckin are not the only players in this price war. The ‘9.9 RMB’ low price strategy has made the coffee industry one of the most competitive sectors in the past year. Coffee brands such as Tims, Starbucks China, and KCOFFEE are also lowering prices and issuing coupons to join the battle. According to Ge Xian, founder of Jingcai Capital, the economic development cycle’s impact on the consumption environment will likely prolong this price war, with freshly brewed coffee penetration entering a new stage amidst this intense competition.