China’s benchmark Shanghai Composite Index (上证综合指数) broke through the 4,000-point mark this week for the first time since 2015 – a historic high for China stock and a symbolic milestone that points to renewed confidence in the country’s markets and ambitions.

The index, widely viewed as a barometer of China’s economic health, has climbed nearly 19% since January. Daily trading volumes have exceeded RMB 2 trillion (USD $280 billion) for more than a month, roughly double last year’s average, showing that ordinary investors, and big institutions are wetting their feet in market waters once more.

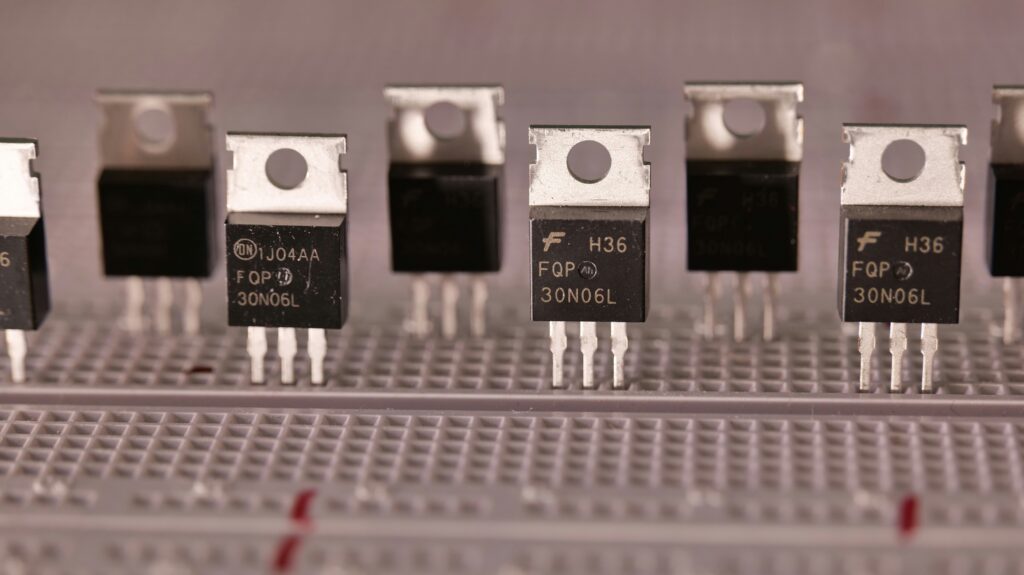

Fuelling the surge is a wave of optimism in what’s often called China’s ‘new economy’ sectors: Semiconductors, AI, and computing stocks. Expectations that the government’s fiscal support and tech reform will keep liquidity flowing and innovation on track has also helped. Analysts say the rally is being driven by genuine earnings momentum rather than speculative trading, even as margin financing climbs to RMB 2.45 trillion (USD $343 billion).

And it’s not just China that’s feeling confident. Global investors are taking note. Morgan Stanley reports U.S. investor interest in China has reached a five-year high, while Goldman Sachs projects a 30% gain in Chinese equities by 2027, citing the strength of the country’s innovation-led growth model.

There’s talk afoot of a slow bull market – one experiencing a steady climb rather than short-term exuberance. With China’s recently announced 15th Five-Year Plan laying out the groundwork for a more self-reliant economy, and one that supports growth in tech sectors, it looks like the slow bull could be a good call.

After several years of slow growth and economic doubt, stock running at this new high is no doubt good news for China. The country’s markets appear to be finding their stride again. They may not pump as they did in the days of mass concrete pouring and mega-scale manufacturing, but the era of AI and computer-chip growth looks set to be one with a lot less risk.