Back in May 2025 it was announced Alibaba (阿里巴巴) would be investing US$250 million in Meitu (美图). The deal was for convertible bonds that could be turned into shares if the company grows and the partnership bears fruit. Those bonds have now been issued.

Meitu is a Chinese company that specialise in beauty and photo apps – the kind of tools that add cute bunny ears to the top of your head or smooth out the skin blemishes you don’t want your social media followers to see. What does Alibaba need that for?

Well, it doesn’t. While the backbone of Meitu’s business has been beauty apps, its newest field is AI tools for e-commerce sellers. These services generate product images and videos automatically, create multiple ad visuals from a single photo, and speed up content creation, especially for platforms handling online retail.

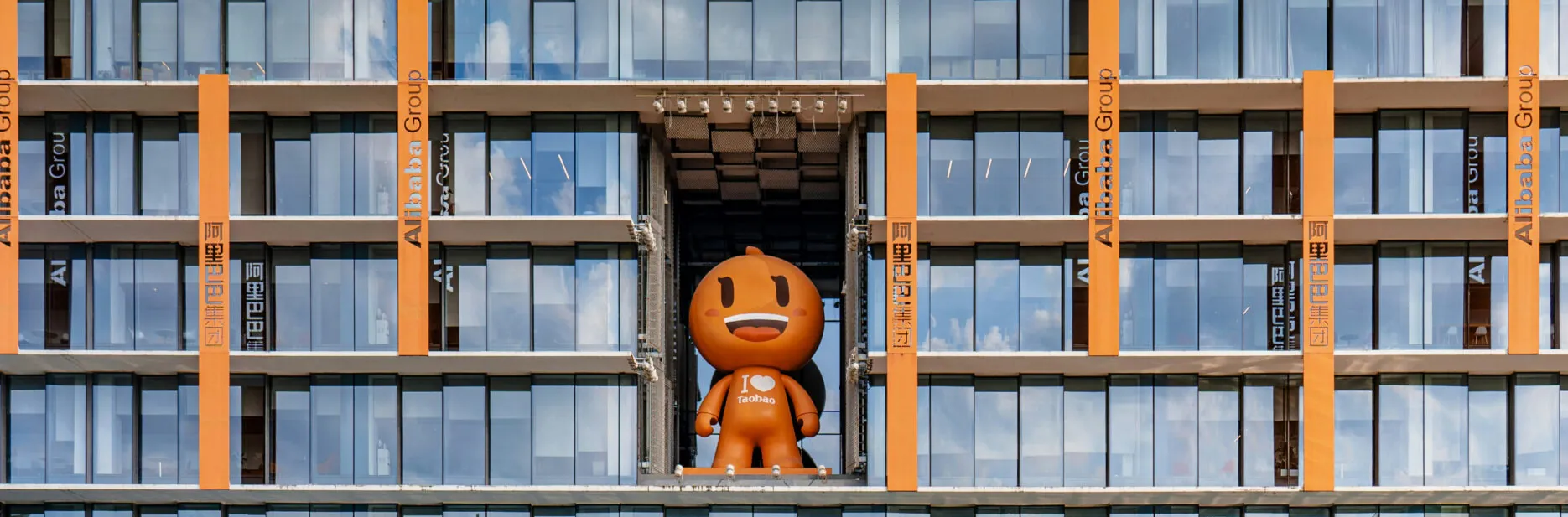

So, if you were Alibaba, and you owned both Taobao and Tmall – which they do – this would be a pretty solid investment… should Meitu’s e-commerce services take off.

If they do, Alibaba has the option to cash in the debt as shares at HK $6 (about US $0.77) each. Behind the financing, the partnership lays out wide-ranging plans for cooperation across e-commerce, artificial intelligence models and cloud computing.

Alibaba will prioritise the promotion of Meitu’s AI-powered e-commerce tools across its platforms. It will also support Meitu in developing new data-driven image and video generation features aimed at improving merchant efficiency on its marketplaces. The two companies also plan to jointly develop foundation models and vertical large language models, covering image, video, multimodal and speech applications.

These are big ambitions, but Meitu is not unambitious. The company has already committed to purchasing no less than RMB 560 million (slightly over US $80 million) worth of cloud services from Alibaba over the next three years, underscoring the scale of its AI ambitions and the computing costs involved.

In all, the deal is a very mutually beneficial one. It positions Meitu more firmly as an AI content and e-commerce services provider, while giving Alibaba preferred access to creative AI tools that support merchant growth across its platforms.