China has effectively barred the use of foreign AI chips in government-funded data centres, tightening its push to replace U.S. technology with homegrown alternatives. The China foreign chip ban was issued as guidance to local authorities and state-backed developers but is expected to be strictly enforced. From now on, any project still under 30% completion must cancel orders for, or remove imported chips. Future builds will be reviewed case by case.

The move targets projects financed by public funds or subsidies – a market estimated to exceed US $100 billion. Major suppliers such as Nvidia, AMD, and Intel are likely wincing right now. No longer will they have access to China’s state AI infrastructure, one of their few remaining footholds in the country after U.S. export controls restricted high-end semiconductor sales.

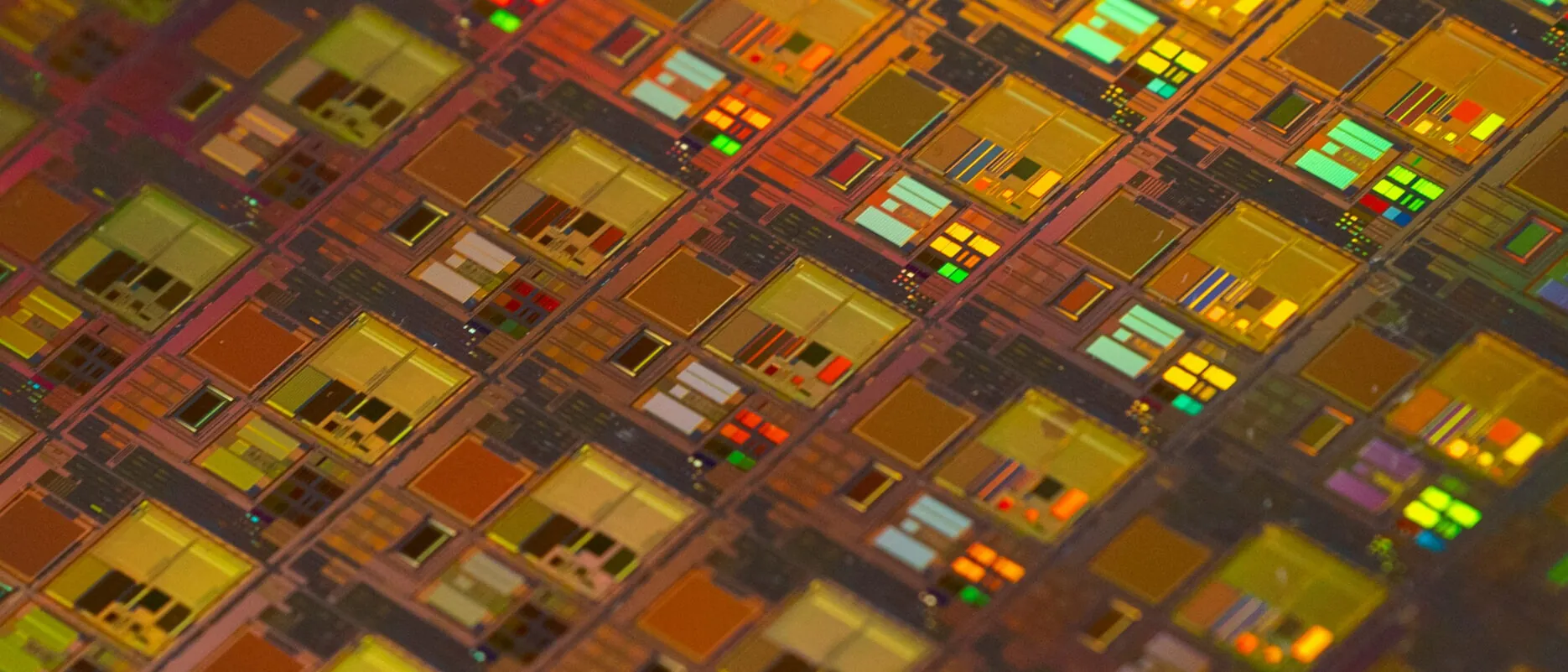

Instead, developers are expected to turn to domestic producers like Huawei (华为), Cambricon (寒武纪科技), and Enflame (燧原科技), whose chips already power parts of China’s cloud and government computing systems. The shift is part of Beijing’s broader tech self-reliance drive, a long-running effort to secure supply chains in critical technologies and reduce vulnerability to foreign sanctions.

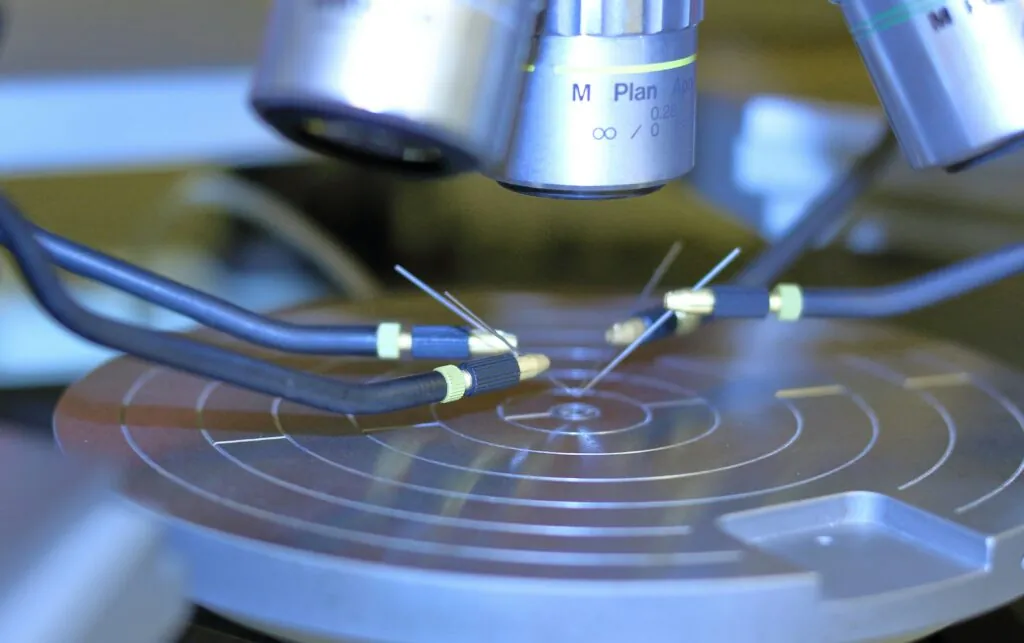

The China foreign chip ban looks to be a significant step in China’s AI hardware decoupling from the west. While Chinese chips still lag behind global leaders in performance and developer ecosystems, Beijing appears willing to prioritise long-term control over short-term capability.

For Nvidia and AMD, the impact could be severe. Both firms have spent years designing China-compliant versions of their AI chips to stay in the market. Now, even those workarounds may find no buyers in state projects – a reminder that in the global chip race, political alignment can matter more than processing power.

In the bigger picture, the ban underscores how the semiconductor standoff has evolved from trade dispute to structural separation. What began with Washington’s export controls is now being mirrored by Beijing’s own protectionism. Each side is fortifying its technological borders. For China, that means betting on its domestic champions to close the gap. For U.S. firms, it’s a warning that even partial access to China’s sizeable tech market is no longer guaranteed.